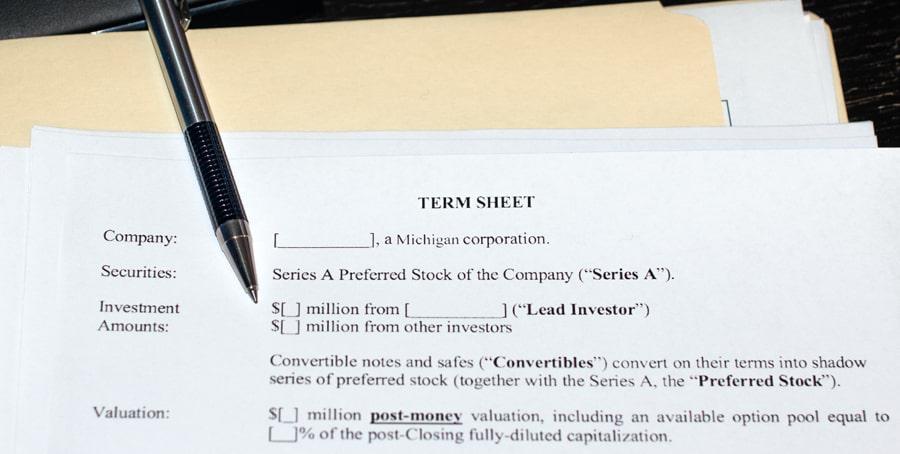

Term Sheets for Capital Investment

When venture capital investors have an interest in purchasing a portion of shares of a company, they want to ensure that their investment is protected and the terms are clearly laid out. In order to accomplish this, a term sheet is used to outline the deal between the company and the investor or group of investors. This sheet functions as a blueprint for an agreement, covering formal investment documents as well as the general terms of the deal. Term sheets may be either binding or non-binding, depending on the circumstances surrounding the deal. These term sheets can be a complex matter depending on the particular deal.

If you are looking to invest in a company or business venture, it is strongly recommended to speak with a lawyer specializing in business law to ensure the term sheet is written and structured correctly in order to best protect your business interests and liabilities.

Common Provisions of a Term Sheet

Anticipated Investment Amount

One of the first things covered by a term sheet is the amount that the new investor anticipates to invest in the company. This can be a set amount or a range of amounts depending on the circumstances.

Amount of Equity Granted

This lays out the amount of equity in the company that will be granted to an investor in exchange for their funding. It also includes any valuation assumptions that are taken into account during equity grants. The most common form of equity given is in the form of convertible preferred stock.

Pre/Post-Money Valuations

An exceptionally important part of terms sheets, the pre-money and post-money valuations are an estimate of the value of the company both before and after the financing infusion per the term sheet. Whether a term sheet includes company valuations in the pre-money stage, post-money stage or both, these valuations have an important impact on the amount of equity investors receive in return for their financing. Because of this, it is vital that they are calculated carefully.

Anti-Dilution Protections and Clauses

These protect investors and shareholders from stock dilution that occurs as a result of the number of shares of stock in a company increasing. By increasing the total number of shares, the stockholders percentage of ownership decreases if they do not purchase more shares of stock to compensate. This is a serious concern for investors, as when their percentage of ownership decreases they have less control over company decisions and also reduces the monetary value of their stock shares.

There are situations however when this is less of a concern. A common instance is when a company issues new shares of stock but the new shareholders pay the same or higher price than the first investor paid for their own shares. Normally in this situation, the overall value of the company will increase with no change to the value of the first investors stocks. Sometimes this can even raise the stock price of shares, benefiting all investors both new and existing.

Investors include the anti-dilution clauses in term sheets to protect their shares in the event that the issuance of new shares decreases the value of their own investments. This is normally accomplished by the adjustment of the price at which preferred stock is converted into common stock. There are two types of anti-dilution provisions commonly used to protect investors: full ratchet anti-dilution clauses and the weighted average method. The first reduces the price at which preferred stock is converted to exactly the price at which new shares are issued. The latter reduces the price at which preferred stock converts however the price is not set to the price at which new shares are issued and instead follows a predetermined formula.

Provisions for Corporate Governance

Corporate governance provisions are a common and important part of corporate operations. These normally appear in a companies certificate of incorporation, as well as their corporate bylaws. In a term sheet, these provisions generally cover the voting and procedural rights of new investors in relation to existing shareholders.

Protective Provisions for Important Decisions

These are included in the term sheet in order to specify important corporate provisions surrounding things such as mergers & acquisitions, stock sales and the issuance of any new debt or equity securities. They also handle minimum voting thresholds as well as the specific shareholders who are required to assent in order to make certain decisions in the company.

Rights to Convert Shares

When convertible preferred shares are issued to investors during financing, the term sheet will detail the specific circumstances under which these shares can be converted to common shares. It also spells out the ratio at which this conversion would go into effect.

Establishment of Right of First Refusal

The Right of First Refusal is an agreement that requires that when the company is issuing new securities, they first offer any of these new shares to an investor before their public offering to third parties. This must be repeated every time the company changes terms of the newly offered securities.

Drag Along Rights

Also known as drag along provisions or bring along rights, these allow a single investor or group of investors to force other shareholders to vote in favor of specific corporate decisions. This normally involves the sale or merger of the company. Typically drag along provisions are used by majority investors to compel minority shareholders to sell their shares of stock in the company under the same terms as the majority investors under specific circumstances. One of the major benefits of these provisions is that it makes it easier for majority shareholders to attract potential buyers in the event they want to exit the company.

Co-Sale Rights

This enables benefiting shareholders to sell a predetermined proportion of their shares in the event that other specified investor classes are also selling their shares of the company. Normally, these co-sale rights give benefiting investors the ability to sell a pro rata portion of their shares to the same party as the other investor classes under comparably favorable terms.

Voting Provisions

Also known as voting rights, these detail the rights of each class of shareholders in a company. This includes new investors in addition to established investors.

Provisions Surrounding Access to Company Information

This covers what particular company information is available to investors, which includes things such as financial statements, meetings with management, etc. It also dictates the frequency with which the investor should receive this information, normally on a either a quarterly, monthly or annual basis.

Key Man Clause

Also known as a key person clause, this ensures investors can protect their investment in a company by making sure that a key individual, employee, executive, or a group thereof will not leave the company. This is especially important in venture capital financing documents, as it protects investments in the company by ensuring that founders, co-founders and critical personnel continue to work for the company after the financing has taken place. Normally, these clauses require that these key individuals continue working for the company for a set amount of time. Usually the consequences for failing to hold up this section of the clause is the investors not being required to make any further investment payments to the company, which is a significant motivation for compliance.

Frequently Asked Questions

Q: Who is responsible for preparing a term sheet?

As a general rule, term sheets are created by the investor. The company being invested in will normally negotiate the term sheet with an investor in order to make it as amicable as possible for both parties. It is vital for investors to work with legal counsel to ensure the term sheet is correctly formatted and is structured in a way that best protects their interests.

Q: Are term sheets modifiable?

Yes, during the negotiation process the term sheet is modifiable. This modification and amending of the term sheet can occur until both the investor and company reach a final agreement, or the time limit set in the term sheet has expired.

Q: Is it possible to cancel a term sheet?

It is possible to cancel a term sheet under certain conditions. A term sheet can be canceled as long as the cancellation date is within the time frame laid out in the agreement. It is possible however that investors can hold companies to exclusivity clauses in a term sheet that prevent the company from working with other investors for a set time period after cancelation.